The most recent monthly update is on top, followed by archives going back to the first monthly update in December of 2011. Please join 2,058,183 visitors from 196 countries (speaking 154 languages) including 50 US States and visit our new website at www.financialecononomicupdate.com.

Financial, Economic and Social Mood Update (March 1, 2026)

The subject of this month’s blog builds upon my blogs from the most recent months. In other words, how are we to address long-standing issues related to the grossly unequal distribution of wealth, how are we to protect the natural environment and how are we to do this fairly while at the same time shoring up our cherished freedoms and democracy?

The concept I shared last month with respect to the very real life and real time proposal to the governments of Papua New Guinea, Bougainville (an autonomous province still within Papua New Guinea), the Philippines, Australia as well as the United Nations has been forming since 2016 or for the last ten years. It is being presented by individuals with solid credentials in the fields of business and government who are long standing voters with center-right leanings (entirely different from the “far right wing” now unfortunately visible in the USA, in parts of Europe and in certain other parts of the globe).

78 percent of the currently quantifiable financial and economic wealth on earth is now in the form of commodities including (in this order) real estate, crude oil, gold, copper, natural gas (methane), silver, platinum and palladium. The surface area of the earth is currently 25 percent land and 75 percent water. Of the surface land 12 percent is currently used for agriculture (crops), 25 percent for agriculture (meadow and pasture land for ranching and grazing), 31 percent consists of forest cover and the remaining 32 percent of the surface land on earth is a combination of deserts, glaciers, barren land and the smallest amount built-up for human habitation.

Much of the meadow and pasture land is now used for domestic herds of farm animals used for human consumption and/or other usage. This population includes 60 million horses, 709 million rabbits, 850 million goats, one billion pigs, 1.7 billion cattle, 2.2 billion sheep and 23.7 billion chickens. An additional 216 billion fish and sea creatures are currently farmed (compares to the wild fish population of 3.5 TRILLION). Many people in today’s world are concerned with both 1) methane emissions and 2) animal cruelty.

The domestic animal populations listed here are already on the decline due to new technology which is already in the process of replacing slaughtered farm animals with laboratory grown meat. As we move forward, more and more of the meat consumed by human beings and other non-human animals with thus be laboratory grown meat instead of slaughtered farm animal meat. Note that this is NOT “fake” meat. It is real meat but grown in laboratories specifically for this purpose. The primary motive here is cost because laboratory grown meat is much less expensive to manufacture. Slaughtered meat will still be available but it will be very expensive – say in very upscale restaurants and in very upscale grocery stores.

The new technology driving this massive global change comes from the same source pushing the world into battery electric vehicles. In other words, it comes largely from northern California’s Silicon Valley. Here is a very informative video on the subject matter which is already transforming global agriculture and putting very many farms (including the largest corporate farms) out of business: https://www.youtube.com/watch?v=NEENR7Ofc5s&list=WL&index=3&t=5s.

Financial, Economic and Social Mood Update (February 1, 2026)

The subject of this month’s blog is about how to address the (global) problem of the gross inequality of the distribution of both wealth and income, and how to tackle this issue while at the same time conserving the earth’s resources and halting the destruction of the natural environment. In my December 2025 monthly financial and economic blog I discussed the issue of “estate planning” – necessary for everyone but at its highest level a vehicle which allows multinational corporations to legally avoid taxation – not a good thing and the way in which wealth becomes ever more concentrated at the very top of society.

Note: this is based upon a real-life proposal which addresses both the grossly unequal distribution of wealth & income and which addresses climate related issues as well (environmental degradation / climate change / global warming). This requires a globally-concerted effort. If not, it will never succeed. This has nothing to do with “socialism” or “communism” as those on the extreme political and social right wing claim. This is in fact supported by a very broad political and economic spectrum including everyone else outside of the extreme right wing including interests such as mainstream conservatives, the center-right and interests in business, finance and politics. As we shall see, the global distribution of wealth is so grossly lopsided that those at the very top deserve tax brackets all their own – including the British Royal family (who own 21 percent of the earth’s surface land) and the likes of billionaires such as Elon Musk who as the earth’s wealthiest individual has a net worth almost 3 times as much as the second richest individual on earth.

We must first quantify in monetary terms the value of all global assets. This particular site does exactly this: https://assetmarketcap.com/. 78 percent of the earth’s financially quantifiable assets are in the form of “commodities” and these commodities in order of financial value are real estate, crude oil, gold, copper, natural gas (methane), silver, Bitcoin, platinum and palladium. 12 percent of the earth’s financial assets are in the form of currencies the most valuable of which are the Chinese Yuan, the US Dollar, the Euro, the Japanese Yen, the British Pound, the South Korean Won, the Hong Kong Dollar, the Australian Dollar, the Taiwan Dollar and the Canadian Dollar. The rest of the world’s wealth is in the form of corporate stock mostly in publicly held corporations traded on global stock exchanges. The most valuable of these corporations in terms of market capitalization are Nvidia, Apple, Google (Alphabet), Microsoft, Amazon, Facebook-Instagram (Meta) and Broadcom.

The biggest asset category above is in the form of real estate / real property. 25 percent of the earth is currently surface land and the remaining 75 percent is surface water in the form of oceans, seas, lakes and rivers. 12 percent of the surface land is used for crops, 25 percent for meadows and pasture land, 31 percent is forest cover and the remaining 32 percent is a combination of deserts, glaciers, barren land and built up land used for human habitation.

The largest landowner in the world is the British Royal family who own 21 percent of the earth’s surface land including 90 percent of Canada. The next largest landowners are the US Federal Government, the Roman Catholic Church and the Inuit people of Nunavut (an autonomous Canadian province / territory).

Since 2016 there has been a valid proposal for the governments of the Philippines, Papua New Guinea and Bougainville (an autonomous province of Papua New Guinea) which will address this most relevant issue facing planet earth and its population human and non-human alike. The proposal would place all resources under governmental oversight with the goal of limiting their extraction for financial profit. This will accomplish the goals of both helping to preserve the natural environment (to address the threat to the earth’s climate as well) and to monetize these assets preserved in their natural state to back national digital currencies. The financial resources generated by this plan will serve to fund governmental budgets as well as to provide the entire population with financial support which can be in many forms such as old age pensions, health insurance, as well as nutritional assistance.

This plan it its test form as proposed for the countries and provinces mentioned above will serve both to alleviate the severely inequitable current distribution of both wealth and income and it will increase the overall quantifiable asset value on earth by 2.8 fold.

Most people will agree that the current situation is not good and getting worse. If we continue down our current path we risk both the destruction of the earth’s natural environment and social unrest. These ideas require the cooperation of local, provincial, national and regional governments across the globe to address the needs and concerns of our entire planet earth and its inhabitants human and non-human alike.

Financial, Economic and Social Mood Update (January 2, 2026)

The subject of this month’s blog is about the political history of the United States going back to the time before the USA declared its independence from the British Empire in 1776. The USA is among a few modern day nation states which has a parliamentary system largely inherited from England. This system is called a “first past the post system” in the modern day UK where seats in parliament are contested by individual districts across the entire country and not awarded according to “proportional representation” as they are in much of the rest of the world. This latter system traces historical roots to the French Revolution of 1789. Many authoritarian governments around the world have representative parliaments with governments of “national unity” which do allow for multiple political parties – but these parties are not allowed to go against the will of the national government – examples here include the People’s Republic of China, North Korea and the former German Democratic Republic (1949 to 1990).

Modern democracies with a “first past the post” parliamentary electoral or voting system include the UK, the USA, Canada, Australia and New Zealand. Most democratic electoral and voting systems in the rest of Europe, Latin America, Africa and Asia use proportional representation or even a hybrid system using some of each of the two described systems. The political system of the modern day UK traces much of its parliamentary origins to the “Magna Carta” of 1215 in which the nobility obtained concessions from the ruling monarch (king).

It is much more difficult to have third or multiple political parties in a “first past the post” system whereas in a parliamentary system we often see many smaller political parties who are represented in parliament. The two large political parties in the USA trace their historical roots to the founding of the USA in 1776 and even before that. The modern day Republican Party or GOP (“Grand Old Party”) grew out of the former Whig Party (before the American Civil War), the National Republican Party of John Quincy Adams (the son of John Adams) and the Federalist Party of George Washington. The modern Day Democratic Party has used its current name since the time of Andrew Jackson. Before 1828 it was known as the Democratic-Republican Party and before that as the Anti-Federalist Party (both names used during the time of Thomas Jefferson. Federalists (such as George Washington, John Adams and Alexander Hamilton) or their predecessors ruled the USA for much of the time of the Continental Congress (1774 to 1781) and the Congress of the Confederation (1781 to 1789) which preceded the current Constitution of the United States (March 04, 1789). The colonial government of the 13 colonies which became the USA on July 04, 1776 can trace their history in North America to the settlement of Jamestown, Virginia in 1607. The largest number of American Presidents (8 in total) came from Virginia including George Washington, Thomas Jefferson, James Madison, James Monroe, William Henry Harrison, Zachary Taylor, John Tyler and Woodrow Wilson. 7 Presidents came from Ohio, 5 from New York, 4 from Massachusetts and two each came from North Carolina, Pennsylvania, Texas and Vermont.

Political loyalties and party affiliation go much deeper than national politics. Generational loyalties are more often than not formed on the State, local (County and City) and on even more local levels where people vote on issues related to school districts, police, fire, libraries, hospitals, judges and public infrastructure.

I chose this interesting subject for my first monthly blog of 2026 because there appears to be a major generational shift in process. This can be seen in the “small” midterm elections of late 2025 which nevertheless encompassed more than 57,000 races across America and in which the Democratic Party “flipped” 21 percent of GOP held seats to themselves due to shifting popular opinion. The shift in the popular vote in Miami, Florida’s mayoral election is massive. The GOP won 85.81 percent of the popular vote as recently as 2017 and they won just 40.54 percent in December 2025. Furthermore, the incoming mayor will be Miami’s first female mayor. She is not a Cuban-American – she was born in Dayton, Ohio and was raised in Albuquerque, New Mexico. The shift in the popular vote in 8 years is a massive 45.27 points away from the Republican Party. This comes upon the heels of the election for Tennessee’s district 7 for the US House of Representatives. The district includes part of suburban Nashville, TN in what was considered to be a “deep red” state. The GOP won just 53.9 percent of the popular vote in December 2025 which is down from 72.2 percent in 2016 – a net loss of 18.3 percentage points.

The Republican Party has been in the driver’s seat especially on the State and local levels of government across America due to the long coattails of Ronald Reagan going back to 1980. Before this the Democratic Party had been the majority party going back to the midterm election of 1930 in the midst of the Great Depression (Wall Street stock market crash of October 1929). The GOP had been in the driver’s seat for much of the period in between the American Civil War (1861 to 1865) and the Great Depression – one short exception was the time period when America entered the First World War on the side of the western Allies in 1917.

The modern day Democratic Party and its direct historical predecessors had been in the majority for much of the time since the election of 1800 (when Thomas Jefferson defeated the incumbent John Adams) and the start of the American Civil War in 1861.

George Washington and John Adams belonged to the Federalist Party, a predecessor of the much later Whig Party and ultimately the new Republican Party of John Frémont and Abraham Lincoln.

Trends have already appeared in public opinion polling for both the midterm election of 2026 and for the US Presidential election of 2028. With respect to the US Presidential election of 2028 the names which stand out on each respective side are those of Gavin Newsom (current Governor of the State of California) on the Democratic side and J.D. Vance on the Republican side with Gavin Newsom already having a lead of more than 7 percentage points in the general nationwide election – polling statistics going back to late 2024. Gavin Newsom is in his second term as Governor of the State of California and Proposition 50 which he backed in response to what is being attempted in Congressional redistricting in the State of Texas (Republican Governor Greg Abbott) won by a margin of 64.4 to 35.6 percent in California winning in all large metropolitan areas (Los Angeles, San Francisco-San Jose Bay Area, San Diego and Sacramento), almost all coastal counties and even in a good number of the inland counties in the southern and central parts of the state. The GOP had lopsided majorities only in the very remote and rural counties in the northeastern part of California largely bordering rural parts of Nevada and Oregon.

Financial, Economic and Social Mood Update (December 1, 2025)

The subject of this month’s blog has to do with how corporations legally avoid paying taxes worldwide. This is the reason why so much of the wealth in the world has been literally transferred from the middle classes not just to the upper classes but specifically to the oligarchy of the small but very powerful billionaire class of about 3,000 individuals and families around the globe.

This is the highest level of what one would call estate planning – something which concerns everyone on the planet. The most basic form of an estate plan is for someone to write and sign a last will and testament. Even if someone has no financial or physical wealth this person would need a last will and testament if they have children. They would state who would raise their minor children in the event of their incapacity or death – say siblings (aunts and uncles) or parents (grandparents of the children).

The second level of estate planning which also concerns everyone (even people with little or no financial or physical wealth) is something called a living will or medical power of attorney. In the even one becomes incapacitated or one has a terminal health condition a person should state if they do or do not want to kept “artificially” alive. Most people would say “no” but in any case this is a very necessary and important decision to make.

The third level of estate planning concerns everyone with financial and physical assets. In the event of a death if one only has a last will and testament these assets will go into legal probate – a very expensive and lengthy process which eats up too much money and time and leaves legal heirs in an unfavorable predicament. A basic credit shelter trust or living trust be it revocable or irrevocable will allow these assets to be transferred to a person’s legal heirs much more quickly and with little to no monetary expense when compared to not having a trust. In the USA this basic form of credit shelter trust will protect assets valued up to USD $30 million for an individual or up to USD $60 million for a couple.

The fourth level of estate planning applies to individuals and families with a net worth beyond the limits just mentioned. These additional trusts are known as charitable trusts in the USA and are meant not just to benefit heirs above and beyond the level of USD $30 million (for an individual) or USD $60 million (for a couple) but are also meant to benefit any qualified non-profit organization of someone’s choice. Everything mentioned thus far is positive in the sense of protecting the interests of heirs, families, family businesses and charitable organizations.

Where the problem lies is in the fifth level of estate planning – the so-called offshore trusts and holding companies. Most of these legal entities are based in very small countries and dependent territories all over the globe – in small island countries such as Mauritius and the Bahamas, in micro states such as Luxembourg and Liechtenstein, in dependent territories such as the British Channel Islands and the Cayman Islands and in some larger sovereign countries including the likes of Switzerland and the Netherlands. Even within countries such as the USA there are certain states which are considered as tax havens for corporate purposes such as Delaware and South Dakota: https://en.wikipedia.org/wiki/Tax_haven.

The representative governments of every single independent country and every single dependent territory on earth must work in unison to eliminate the legal loopholes in the fifth level of estate planning. This is the reason why the vast majority of people on earth fail to benefit from the fruits of their own labor and why a small number of powerful people at the top of the economic pyramid pay so little in taxes.

The reason why offshore trusts and holding companies exist is to avoid taxation across national and other borders. This example is about Nike, the sporting equipment company legally based in the Netherlands and its Bermuda-based subsidiary which owns the rights to the Nike logo and brand: https://www.instagram.com/reels/DQJtxvljx6d/.

Financial, Economic and Social Mood Update (November 1, 2025)

The fiscal predicament of the American federal government continued to deteriorate at an alarming rate in the month of September 2025. At least 60 percent of what the federal government now spends is money we do not have – brand new debt in the form of credit created out of thin air and backed by nothing. The amount of “new” debt issued in calendar year 2025 equals the following: US Treasuries = $5.657 TRILLION, federal agency securities = $1.6926 TRILLION and municipal bonds = $0.6762 TRILLION = a grand total of USD $8.0258 TRILLION. The federal government portion alone = USD $7.3496 TRILLION. Tax receipts in calendar year 2024 were USD $4.9 TRILLION and they are falling this year due to the collapsing economy and due to the “big beautiful” tax cuts plus a 40 percent staff cut at the IRS. Here is a 24-minute video detailing the upcoming collapse of the bond market featuring speakers such as Jamie Dimon and Ray Dalio: https://www.youtube.com/watch?v=dwOuTMa9iLs&t=1127s.

The reports in late October 2025 with respect to the increase in the national debt of the USA have gotten even worse. The national debt of the federal government has surpassed USD $38 TRILLION and it surpassed USD $37 TRILLION only two (2) months ago. If this is the case tax revenues have to be collapsing due to multiple reasons: the so-called tax cuts in the “Big Beautiful Bill,” tariff revenue in no way making up for these cuts, no taxpayer audits being done at the IRS (due to the government shutdown and due to reduced human resources / personnel), and on top of all this a collapse in consumer spending which leads to a collapse in economic activity which leads to a collapse in government tax revenue. We have to be near the end of the road because federal outlays (spending) equal about USD $7 TRILLION per year. If the debt is now increasing at an annual rate of USD $6 TRILLION this means our tax revenue is shrinking to almost nothing. This is an absolute disaster for the value of our currency and for our standard of living.

Note: a collapse in bond prices means that yields (interest rates) will skyrocket. Bond prices and yields have a perfect inverse relationship – there is no other mathematical possibility, period. The situation is so dire that the entire existing political class (both major parties) from the President on down should be permanently removed. Something in the form of a professionally educated and experienced management team needs to get our house in order and at the same time try to ensure that basic necessities such as Social Security, Medicare, Medicaid, SNAP (“food stamps”), TANF, WIC and the Affordable Care Act and other entitlement programs continue to function. We simply no longer have the resources to do anything else be it other programs including so-called national defense and the military.

The asset market is also continuing to collapse at an alarming rate, most noticeably for most people in the form of the real property market where the majority of people who own assets do so in the form of their primary residence or home (98 percent of people DO NOT have a net worth because their debt exceeds their total assets). This trend is now nationwide in all 50 states and 22 of the states are now officially in an economic “recession” according to official government data – the reality is likely much worse than this.

The two most expensive states in terms of cost of living and housing are consistently Hawaii and California in this order and values here are collapsing in real time as well. Average home price in Hawaii has dropped by 3 percent in the past year after a much larger drop in the year before this one – the cumulative 2-year decline is no less than 15 percent and likely closer to 20 percent. The average price decline in the state of California is even more severe – at least 13 percent over the last 12 months and a cumulative 2-year decline of at least 18 percent. For sale inventory and average time on the market has exploded across the USA and in many other countries as well especially in Europe and Asia. The US real estate market appears to be collapsing the most severely in the over-built sunbelt states such as Florida, Texas, Arizona, California and Nevada. An excellent source for accurate real-time information on the US real estate market is Nick Gerli’s Reventure Consulting: https://www.youtube.com/watch?v=jDpLCQijQMg&t=302s.

Financial, Economic and Social Mood Update (October 1, 2025)

The labor market is facing lethal headwinds not just due to the impending deflationary collapse (like the “Great Depression” from 1929 although it will be much more severe this time around) but due to the rise of “Artificial Intelligence” (AI). Here is a video with a chilling message – forecasting global unemployment of not merely 10 percent but of a staggering 99 percent: https://www.instagram.com/reel/DOK9DmVAFxC/?igsh=MTliNGVuOHB6NWV6Yg%3D%3D.

As I said in my September 2025 monthly blog, the so-called “Big Beautiful Bill” is a terrible mistake. Many people who voted for both of the two major American political parties feel this way – this is not strictly a political issue. Ideally the entire bill should be overturned, the tax cuts especially for corporations rescinded and the cuts in social programs restored to their previous levels. The majority of the population depends upon the major entitlement programs for their basis sustenance and here I refer to the likes of Social Security, Medicare, Medicaid, the Affordable Healthcare Act (“Obamacare”) and SNAP (“Food Stamps”). We are still at a point where the cost of living is rising and purchasing power is falling, so we are not yet at a point where these programs can be cut. Furthermore it is a huge mistake to increase the military budget to USD $1 TRILLION – this should be cut by at least 90 percent. We simply cannot afford this madness.

Artificial Intelligence (AI) is no longer a fantasy. It is real and it is already in the process of permanently displacing millions, tens of millions, hundreds of millions and eventually billions of workers all over the planet. It is also helping to make the centi-billionaire, the deca-billionaire, the billionaire, centi-millionaire and deca-millionaire class ever wealthier and more powerful. These are the people “benefiting” financially and economically from the nominal global stock markets and the investment banks, high-technology firms, defense contractors and big pharmaceutical companies publicly listed on the global stock exchanges. With his new Tesla pay plan (compensation package) Elon Musk stands on the threshold of becoming the world’s first official “trillionaire” – joining the likes of powerful banking families behind the global political facades such as the Rothschild, the Rockefeller and Wallenberg families.

It is high time for political parties – and not merely the communist, Marxist and socialist parties of the political left – to embrace the idea of a separate and much higher rate of confiscation of both income and assets of the ultra-rich and ultra-powerful classes at the top of the global human pyramid.

The fiscal predicament of the US federal government is continuing to deteriorate. Tax receipts are collapsing due to the collapsing level of economic activity. The monthly deficit in August 2025 when annualized to twelve full months now equals a staggering USD $4.14 TRILLION = 59 percent of federal spending thus comprised of “printed money” (actually credit created out of thin air) – money which we do not have and money which does not exist.

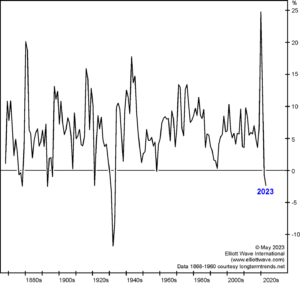

One of my alert subscribers pointed out that even the global equity market (i.e., the stock market) is not that great considering the “real” value of our money, i.e., factoring in inflation or the Consumer Price Index (CPI) – or better yet, the stock market valued in gold bullion. She is absolutely correct! In fact, the Dow Jones Industrial Index has made no “real” progress since May 1929 when valued in gold – since before the “Great Depression” which supposedly commenced on Black Friday in October of 1929 – almost 96 long years ago – almost one full century ago. That is reality and that is one very sobering thought for us to ponder.

Nicholas Gerli of “Reventure Consulting” (I strongly recommend him – I am one of his many satisfied clients) says that the mortgage default rate in the USA is now 12 percent and rising. This means that the entire banking system which works on very thin margins is already illiquid for all intents and purposes.

We are on a sinking ship. It is high time that we cease attacking each other, fighting each other and calling each other bad names – our language is powerful and we should stop using it in the wrong way. We need to find common ground for our common good and work together to salvage what we can and to fix this mess in which we find ourselves. Because of not, when we sink we will all sink and drown together.

Financial, Economic and Social Mood Update (September 1, 2025)

The recently passed so-called “big beautiful bill” has net interest payments on the national debt of the USA (federal government only – does not include state & local governments, nonprofit organizations or the so-called private economy of corporations and individuals) making up an incredible 18 percent of federal government revenues. What is the rest? Here it is: Social Security (31 percent), Medicare (18 percent), National Defense = War (17 percent), and Medicaid (13 percent). This equals 97 percent. There is actually much more in many smaller programs but we would go well over 100 percent due to the annual deficit = i.e., spending much more money than we have.

What does this mean? The Western Roman Empire fell in A.D. 476, the Eastern Roman Empire fell in 1453, the Aztec Empire fell in 1521, the Inca Empire fell in 1572, the Mexican Empire fell in 1867, the French Empire fell in 1870, the Korean Empire fell in 1910, the Tsarist Russian Empire fell in 1917, Austria-Hungary fell in 1918, the Prussian-German colonial empire fell in 1920, the Ottoman Turkish Empire fell in 1922, Nazi Germany fell in 1945, the Empire of Japan fell in 1947, the USSR collapsed in 1991 and the USA is not far off.

Everyone should ignore the mouthpieces of the Administration in Washington, D.C. and the mainstream media. This YouTube channel by Michael Bordenaro normally comes out of Florida where he lives. This particular episode was recorded in Marin County, California but what he says about the current economy, employment market and real property market is one hundred percent factual and true: https://www.youtube.com/watch?v=9rIXyAlkhRo&t=760s. Things are extremely bad (not just somewhat bad or a little bad) and they are about to get very much worse.

Yet another YouTube channel focused on the everyday plight of people struggling to make ends meet in today’s world is “A Homestead Journey.” Listen to these people describe their struggles in an unedited format: https://www.youtube.com/watch?v=wN2ZOAXshU0&t=11s. It is both dangerous and morally unacceptable for any society to have as many “have nots” as our society has today. It is a threat to the social order, to public safety, to the stability of government and to the freedoms we take for granted. Our priorities as a society need to be corrected.

Those who read this blog know that I do not like the idea of tariffs at all. Tariffs behave like sales taxes but as we know the rates are much worse (higher). Furthermore, those who say or believe that tariff revenue will somehow replace income tax revenue are simply wrong. The case in point is that the annual US federal deficit as of July 2025 is running at an annualized rate of USD $3.492 TRILLION per year (50 percent of total spending) – a complete disaster which merely adds to the already massive US federal debt. Another point is that increased levels of debt cause interest rates to increase and not to lower them – the greater level of debt raises risk which increases interest rates.

Tariffs now affect very many consumer goods but of course the most visible good are the biggest single ticket items such as passenger cars and light trucks. One “goal” behind implementing tariffs is to bring manufacturing activity back into the USA and/or to American-owned companies. The reality is showing this to be much like pie in the sky – something that will likely never happen. The only American carmakers left of any consequence (or size) are General Motors and Ford. They have about 30 percent of the retail vehicle market in the USA, Canada and Mexico, somewhat less in Central and South America and very much less in the rest of the world. Their global share is about 11 percent but when one includes three and two-wheelers which in the rest of the world serve as primary transportation the global market share of GM and Ford falls to merely 4 percent of the total.

American car companies reached their peak in 1947 (78 years ago) when they had 97 percent of the global market. General Motors alone had half the world market. This will never come back.

On top of this the entire global vehicle market is undergoing a massive transformation from the ICE (internal combustion engine powered by gasoline or diesel fuel) to alternative fuels mainly BEV (battery electric vehicles). BEV technology is most advanced in mainland China which is now by far the largest overall auto market on earth – as big as the USA and the European Union (EU) combined. More advanced BEV technology translates into longer range, lower production cost, lower retail prices and improved quality. Chinese domination in auto production is even more pronounced than their domination as a retail market – China manufactures as many vehicles as the USA, the European Union (EU) and Japan combined. Global BEV market share reached 25 percent in 2024 and is on track to reach 30 percent in 2025 – the forecast for 2030 is double that amount or 60 percent. Another excellent channel on YouTube which concentrates on the global auto market is “The Electric Viking” by Sam Evins out of Australia: https://www.youtube.com/watch?v=LfeHQmA8mNg.

Many of the very well-known “legacy” automakers in the USA, Europe, Japan and South Korea will likely not survive much longer – they are being passed up by manufacturers from mainland China (battery electric cars and light trucks) and India (three and two wheelers including motorized tricycles, motorcycles, scooters and bicycles).

Financial, Economic and Social Mood Update (August 1, 2025)

The peak of the global real estate market likely happened during the height of the Covid-19 pandemic in 2021. This was an entirely unnatural and unhealthy situation from many standpoints, especially the way it was handled by governments around the world. In hindsight, social distancing, face masks, remote work from home, vaccine mandates and “stimulus” (printed money which went mainly to those in the top tier of the population) were all terrible ideas. The stimulus and the remote work from home mandates in particular made people do things they never should have done. In the case of the real estate market, people moved to places they never should have moved to in the first place.

The payback time for these bad decisions is now upon us. Nicholas Gerli of the “Reventure Consulting” channel seen on YouTube says that the first phase of the crash is with us now and he is entirely correct. The property markets I follow specifically in New York, New Jersey, Virginia, Georgia, Arizona, New Mexico and California have already fallen by as much as 48 percent in value. These markets include metro areas such as greater New York, Hampton Roads-Tidewater, Atlanta, Phoenix, Tucson, Santa Fe and the San Francisco Bay Area. Keep in mind that we are merely in the first phase of this asset value collapse – we have yet to experience the second phase which will obliterate whatever happens to be left over.

Understand that the many real estate investment giants who “guestimate” values (such as Zillow, Realtor, Redfin, Xome, Trulia, etc.) already have so-called values over a very broad range – from pie-in-the-sky too high to rock bottom and below for cash on the barrel. The current state of the economy (pretty much worldwide and not confined to any one country) is already not good – we are in a huge asset bubble and the bubble is in the process of deflating due to far too much debt and collapsing human demographics. And then huge economies such as China (and other countries around China) that have been driving sky high prices in the USA (especially on the Pacific Coast) are experiencing an even more ferocious downturn. Real estate prices in China have fallen by as much as 79 percent and this has a direct cause & effect on their ability (or inability) to invest money elsewhere on the planet.

Perhaps an example of the least rational part of the “real estate” market lies within the sphere of cryptocurrency. Digital currency may not be a bad idea, but all cryptocurrencies are basically backed by nothing. They all have certain technological “attributes” such as types of advertising, virtual private networks (VPNs), some are tied to the price level of various national currencies or even to certain precious metals such as the price of gold or silver – but they are still backed by nothing. Some cryptocurrencies represent “virtual real estate.” That’s right – real estate that has no real physical existence. Real estate in a virtual, make-believe world of virtual but not real reality – and incredibly, there have been real live human beings who have spent millions of real Dollars to purchase virtual real estate that does not really exist. One such cryptocurrency launched in 2017 called “Decentraland” (MANA) has already lost an incredible 91.76 percent of its historical peak value from merely a few years ago.

Other cryptocurrencies (not necessarily having anything to do with virtual real estate) have lost even more value than MANA. One example is ZCash (ZEC) created in 2016 as a “privacy-based, anonymous” alternative to Bitcoin – keeping those who own it “anonymous.” This concept of giving owners more privacy doesn’t sound bad but ZEC has lost an incredible 98.14 percent of its peak value to date.

Financial, Economic and Social Mood Update (July 1, 2025)

Like it or not, the entire global financial system is now in the midst of a major multi-generational reset. The world’s financial weight or center of financial power has been and continues to shift toward Asia – Mainland China, India, the ASEAN nations of Southeast Asia, the Middle East / Persian Gulf and Russia / Central Asia / Siberia. A multipolar world is in the process of replacing the historical US dominance which goes back to 1944 when the USA replaced the UK as the number one global financial center of power. The global dominance of the UK endured from 1588 to 1944. The Royal Navy’s defeat of the Spanish Armada (navy) is the generally accepted milestone for this event. The Roman Catholic powers of the Kingdom of Spain, the Kingdom of Portugal and the Frankish Kingdom (which eventually became the “Holy Roman Empire of the German Nation” which included much of modern day Central Europe) was the primary financial power (in the western world) before the British Empire. This in no way minimizes the power or the accomplishments with great respect to the very advanced and even older civilizations / empires in Egypt and Mesopotamia / Iraq (the “Semites”), India, China (the great “Middle Kingdom”), the Inca Empire of South America and of course the great Aztec and Toltec Empires of Central America.

One very positive sign amidst the debt, deficit, liquidity problems and fiat currency problems especially in the USA, Europe and Mainland China is the fact that gold bullion now represents an impressive 3.95 percent of all global financial assets. This is happening in particular because gold reserves are being bolstered by Mainland China, Hong Kong (part of China), Dubai (part of the United Arab Emirates), Malaysia, Singapore, the ASEAN nation block of Southeast Asia, Taiwan, South Africa and Germany.

Safewealth Group of Switzerland (an ally of Elliott Wave International of Atlanta and a provider of precious metal and cash note storage services to many of the world’s wealthiest individuals and families) believes that the price of gold will reach as much as USD $12,500 per ounce by the end of this decade or so.

The financial problems of the US federal government have pushed 20-year yields on Treasury Bonds above 5.1 percent per annum. Insurance companies such as Gainbridge pay up to 5.8 percent on their annuities which run up to 10 years in maturity – keep in mind this is not a commercial bank and this type of product is not “guaranteed” by the FDIC. Whatever inflation still existing amidst an emerging global deflationary depression and human demographic collapse (declining fertility rates and declining birth rates) is now caused by underlying supply chain constraints (made worse by how the Covid-19 pandemic was handled globally with lockdowns, social distancing, remote work, economic stimulus masks and vaccine mandates) and trade tariffs. Corporate profit margins are being squeezed and real incomes adjusted for purchasing power continue to decline. Tax cuts and stimulus spending both risk making things worse instead of better due to the ill health of governments in the western world and China.

Following up on the themes discussed in my June 2025 blog, Safewealth Group of Switzerland believes that the stock market will likely bottom around 2031 or 2032. The two other primary precious metals (in addition to gold) likely to increase in value are silver and platinum. Silver both a major precious metal and an industrial metal – it may reach USD $70 per ounce by the end of the decade. Platinum has historically been even more valuable than gold but is today severely undervalued. It should reach at least USD $5,000 per ounce by the end of the decade or so.

Every single war on earth must stop (no exceptions whatsoever) and the US federal government is going from already very bad to even worse by growing its never-ending deficit spending and money printing. The entire system is hopelessly corrupt, bought off and must be replaced from the ground up.

Financial, Economic and Social Mood Update (June 1, 2025)

The tariffs on retail consumer goods from Mainland China for sale on Amazon have added 17.46 percent to the total purchase price compared to the end of March 2025 before any tariffs were in place. The tariffs were a sky-high 70 percent for a few weeks in April and May before the “agreement” with China. It looks like goods from Europe (the European Union) may now be subject to very high 50 percent tariffs – they have been postponed only until early July 2025 pending talks and negotiations.

The bond markets tell us that interest rates will rise largely because the US federal budget deficit continues to rise into the stratosphere as it has done for the past quarter century. Even the “balanced budget” of 25 years ago was not really balanced – it merely “removed” the major entitlement programs such as Social Security and Medicare from the official calculation which is not an honest representation of the truth. The last true “balanced budget” would take us back more than 50 years in time. In any case, we are in one hell of mess.

The geopolitical shenanigans of the American empire over the past years, decades and even centuries have finally motivated most of the rest of the world to move away from using the US Dollar as the primary means of monetary trade and from using the currency as the primary reserve currency just as the British Pound Sterling lost its status toward the end of World War Two with Bretton Woods in July 1944. The rest of the world led by the BRICS, the SCO (Shanghai Cooperation Organisation) and the Chinese BRI (Belt Road Initiative) are already well underway in abandoning the American Dollar. They represent about 86 percent of humanity. The European Union (EU) is of course a much smaller global player but they will likely follow suit. The parts of the world “solidly committed” to the US Dollar comprise no more than 5 percent of the entire global population.

Back to the real property market – rental income is finally falling in a noticeable way but these prices are still far too high. Real estate prices are indeed coming down in very major markets in the USA such as Florida, Texas and beyond (largely in the overly inflated Sunbelt) as was as in Asian countries which have been fueling the sky high prices in US states such as Hawaii and California.

Nicholas Gerli of Reventure Consulting on his YouTube channel does an absolutely excellent job of analyzing the US housing market and of the economy in general. He points out that there is now a bona-fide demographic decline in 15 out of 50 US states (more deaths than births). Globally we have finally reached zero or negative human population growth. The latest statistics I have seen imply that fertility rates are now below that necessary for basic replacement in every single country on earth. Regardless, human demographics are in a “natural” collapse for the first time in recorded history – more deaths than births not primarily due to something like plague or war. The economic ramifications of this fact are and will be nothing less than massive. This demographic collapse will come upon the emerging deflationary depression and should make it even more pronounced that it was in 1929. As mentioned last month asset prices crashed by 89 percent from 1929 to 1932 and nominal asset and service price values did not recover until 1954 – a span of 25 years or one-quarter century. This time around it should be even more severe. I expect prices to collapse at least until the year 2030 and the overall loss should reach a cumulative 98 to 99 percent of the bubble highs before the world starts to rebuild something much better from the ground up.

Collapsing human demographics mean that the demand for everything (with no exceptions – both goods and services) will fall to the ground. Nicholas Gerli recently pointed to the sales of brand new RVs (recreational vehicles) and SUVs (sport utility vehicles and off-road vehicles) collapsing from 50 to 60 percent – and we are still in the beginning stages of the collapse. Ditto with far fewer children in states such as Florida where deaths exceed births. This translates to far fewer children in the school systems of cities and counties, which means that far fewer teachers and other employees are needed compared to before – this translates into falling employment.

Collapsing demand for goods and services means that many governments will go bankrupt due to collapsing tax revenue (already happening in Mainland China on the local government level). It also means that many businesses will not survive. Businesses which do succeed will likely have to seek growth not out of overall economic growth (because there will be none) but out of the “hide” of their direct competitors who are not as lean and mean and tough as they are.

Here is more unpleasant news but necessary for all of us to hear and face: I have no doubt that all homeowners reading this blog have already seen their insurance rates skyrocket – say triple what we were paying before the Covid-19 pandemic in 2020. Things are now so bad that many large and well-known insurance companies are literally pulling out of major property markets – in other words, homeowners will even find it challenging to get insurance in the first place. And it they do get it, it will extremely expensive (and NOT cover the entire market value of the property). Toxic insurance markets losing insurance providers include Florida (AAA, Farmers, Bankers, Lexington), Texas (Farmers, Nationwide, Liberty Mutual, Progressive), California (Nationwide, Kemper, Merastar, Unitrin, Allstate, State Farm), Colorado, Connecticut (Allstate, Aetna, UPC, Narragansett Bay, Kemper and National Grange), New Mexico (Kemper), all coastal areas in the Pacific, Atlantic and Gulf of Mexico (Cincinnati Financial), Arkansas (Allstate), Louisiana, Minnesota, Oklahoma (Allstate), South Carolina (Allstate), South Dakota, Washington, Arizona (Allstate), Idaho (Allstate), Kansas (Allstate), Maine (Allstate), Michigan (Allstate), Montana (Allstate), North Carolina (Allstate), Oregon (Allstate), and Rhode Island (Allstate). High-end properties in the multi-million Dollar range of cost basis are now covered for a mere 50 percent of their replacement value and annual premiums in general (for all types of real property regardless of cost basis) are now averaging 0.33 percent of fair market value. Prices in “toxic” markets such as the “poster child” insurance markets in Florida and Texas are much, much higher.

Financial, Economic and Social Mood Update (May 1, 2025)

The estimate for federal government layoffs from January 20 to February 28, 2025 = 331,780, for March 2025 = 280,000, for April 2025 and then US Army active duty reduction in force (RIF) = 90,000 = 701,780 job cuts thus far. The pace of these cuts has slowed markedly during the month of April as they represent 27 percent of the full-time equivalent federal staff as of January 19, 2025. Certain agencies with very intensive “retail customer” contact such as the US Post Office and the Social Security Administration should not be cut at all as they are so critical to so many people.

About 75 percent of the federal budget is classified as “non-discretionary.” Such items include interest on the federal debt, social security, Medicare, Medicaid and other “entitlement” programs such as disability, worker’s compensation, SNAP (“food stamps”), WIC and TANF. The rest of the budget must come under scrutiny for massive reductions given the dire state of the finances of the USA – there is absolutely no room for “increase” in any other area.

The current goal to cut the national defense budget by 40 percent in five (5) years is absolutely necessary and this should be increased to 50, 60, 70, 80 or even 90 percent to be cut. America is broke and the American empire is falling – this is fact above any political party affiliation or preference. All historical empires have risen and fallen and the USA is no exception. At the end of the day, every empire should fall – they harm the interests of weaker and smaller peoples, cultures, ethnicities, races and countries worldwide (New world, Old world, Northern Hemisphere and Southern Hemisphere alike) and have done so for thousands of years of recorded human history. One can say that the American empire commenced with the first “permanent” European settlement in Jamestown, Virginia in 1607 and that this self-described (often religious, more often than not “Christian Manifest Destiny”) continued until all of the Native American nations were obliterated and then the American empire continued to cross the entire Pacific Ocean and to subjugate Latin America and the Caribbean. After the fall of the British Empire following the end of World War Two (upon which “the sun never set”) the American empire picked up the baton and continued to act as the world’s “policeman” until the present day. This must end.

The total cumulative number of Illegal immigrants deported or incarcerated thus far (during the last year of the former Biden-Harris Administration plus the 4 months of the Trump-Vance Administration = 525,000 individuals. Budget cuts coming from the USA have reduced illegal immigration worldwide as so many non-governmental and non-American entities (Churches included in particular the Roman Catholic Church led from the Vatican) were receiving printed American money – this gravy train of printed money must end as well.

There is nothing wrong with immigration and legal immigration worldwide is good, necessary and normal – this should have nothing to do with race, ethnicity, national origin or culture. Illegal immigration and the desire to displace, replace or “cleanse” populations is not good and must forever end. Another point to remember is that the source countries for immigrants are often losing so many of their own people because most countries on earth have had their economies deliberately ruined – this must stop as well. People everywhere need to be able to survive, thrive and prosper in peace wherever they are. This is yet another reason why every single war must forever end.

The US tariff policy has the supposed goal of returning manufacturing employment to the USA and to hopefully “replace” the income tax. The latter goal is simply not feasible. The most optimistic estimates have the tariffs comprising no more than 12 percent of current federal expenditures and in reality the number is in low single digits. The first goal is admirable (not merely for the USA but for all countries which have lost manufacturing jobs over the past decades) but it is far easier said than done. Resurrecting 90,000 factories closed in the USA over the last have century would be horrendously expensive. On top of this, factory workers will have to be both trained and paid. Wages in the countries to which factories have relocated are far lower than in the USA or other high-income countries. Simply put, corporate managers will not do this on such a massive scale due to reasons of basic economics and profitability. At the end of the day every single tariff or import / export duty worldwide should be eliminated forever.

Going back to what I said with respect to basic income “entitlement programs” the lower social classes worldwide do not pay much tax because they do not have the financial resources to do so. Furthermore, eliminating or cutting these benefits would lead to social unrest (riots in the streets) – not a good thing. People in the middle of the social structure (circa 25 percent of the population at most) are already being squeezed with both work and paying taxes.

People in the top tier who basically own the corporations of the world need to contribute more especially via the corporations they own – many of these entities paying little to no tax today. On top of this is the issue of so-called “nonprofit” organizations such as churches, organized religions, hospitals, charities and the like. These organizations need to start paying taxes as well as so many of them have such massive financial resources which until this time have been enjoying a free ride at the expense of everyone else.

So many people worldwide are or remain “indigent” because real asset prices are too high and because their real incomes are too low – they have too little purchasing power (the cost of living is too high). Asset prices are severely inflated and must come back down to earth. The asset market crash from January 2000 to October 2002 saw nominal prices drop by 41 percent. The market recovered to reach a new high but crashed again from October 2007 to March 2009 by an even more severe 63 percent. Prices once again recovered to reach a record nominal high by December 2024.

I believe that the employment market peaked no later than sometime in 2023 – in other words the entire world entered a deflationary depression sometime from 2022 to 2023 although most people were not aware of it. During the historical “Great Depression” the asset market lost 89 percent of its nominal value from October 1929 to July 1932. Nominal asset prices and even consumer prices such as monthly rental income did not recover their October 1929 levels until November 1954 – more than 9 years after end of World War Two.

This sounds bad but if we are to find a silver lining therein it would be that the crash in prices allowed many more people to eventually make their financial and economic ends meet. Only 22 percent of people today are “homeowners” and the majority of these are only so due to quasi-public “affordable housing” programs in more expensive jurisdictions. Interest rates are NOT the problem – high prices are the problem. If asset prices were to drop say 50 percent then hopefully 44 percent of people could afford to become homeowners. If asset prices were to crash by 75 percent then perhaps 88 percent of people will become homeowners. If asset prices collapse by 87.5 percent then more than 90 or 95 percent of people could become more financially independent than they are today. This is basically what transpired during the high growth period from 1945 to 1980.

Remember that debt (a bond) is an asset for someone who owns the bond. When asset prices collapse bond prices will drop. When bond prices drop then interest rates will rise – bond prices and interest rates have a zero sum inverse relationship. Furthermore, Central Banks do not control the direction of interest rates – they merely follow what the bond market does. Due to this reality it makes no sense to remove the Chairman of the Central Bank. And I suppose we can all thank the late Paul Volcker (1927-2019) for what he did from 1979 to 1987. Temporal inflation was nipped in the bud. Bank time deposits reached a peak of 22 percent interest in January 1981 and the brand new retail IRA deposits (then $2,000 per year) paid us from 40 to 50 percent interest from December 31, 1980 to April 15, 1981 (income tax day) – these were promotional “teaser” interest rates run by commercial banks and by former “Savings and Loan Associations” back in the day.

These are the hard realities of the world in which we live. We need to get our “house in order” if the future is ever going to look better than it does today.

Financial, Economic and Social Mood Update (April 2, 2025)

The USA has been effectively bankrupt for some time now – in other words, before the time of the current administration, its immediate predecessors, before the time of Barack Obama, and before the time of both Bush Presidencies. The national debt of the USA (USD $36.6 TRILLION) and especially the off-balance sheet items including unfunded liabilities for pensions, social security, healthcare, Medicare, Medicaid and the like (USD $281.5 TRILLION) cannot be paid off in any “normal” way. This will be done through a form of bankruptcy which must necessarily involve payment in the form of physical assets to the holders of debt.

Even financially healthy companies and entities “downsize” with short term staff reductions of 30 percent or so. What the US Department of Government Efficiency (D.O.G.E.) is doing is necessary and had to be done sooner or later – and better sooner rather than later. Employment at the US Federal Government reached an all-time high in 1990 with a FTE (full time equivalent) civilian staff of 3.4 million employees. The initial level of current reductions equal at least 331,780 individuals which include those not yet meeting one-year probation (200,000) and those accepting an early cash buyout – many of these people being already close to retirement (75,000 people). Of the remaining 2,260,000 employees a reduction of 30 to 40 percent of this total will be “downsized” in the coming years (this is the stated goal of D.O.G.E.). The ripple effect in the general US economy due to government contracts paid outside of the government is a multiplier of 8.4 which equals a total sum of circa 8.5 million to 10.4 million jobs to be downsized in the public and “near public” sector of the economy.

The entire US workforce of full-time and part-time employees (public and private sectors) is about 163.4 million people. Labor force statistics as of February 28, 2025 already showed a net decline in public sector employment (largely due to DOGE), a decline in foreign born people employed in the USA (due to the decline in net immigration) but corresponding increases in private sector employment (especially in the all-important manufacturing and in the automotive sectors) and a net increase in employment for people born in the USA.

In sum, the very necessary DOGE cuts equal less than 7 percent of the entire US labor force and this is currently being offset by employment growth in the private sector – which is the goal of DOGE. Furthermore, the global stock market “corrections” to date a mere 4.52 percent of all time high nominal value.

As mentioned in last month’s update, asset prices & service prices (the overall cost of living) are so high that most people can no longer afford to purchase either a new home (with a mortgage) or a new vehicle (with an auto loan). The problem here is NOT interest rates – is the inflated prices. If asset prices were to collapse by 50 percent only 44 percent of people could purchase a home with a mortgage (double the amount right now). If asset prices were to collapse by 75 percent this number would increase to 88 percent – much more in line with the historical average going back more than 250 years.

None of what I describe above is unusual. Recent asset market crashes did similarly. The crash of January 2000 to October 2002 crashed prices by 41 percent. The crash of October 2007 to March 2009 crashed prices by 63 percent. The “Great Depression” of 1929 to 1941 (beyond to 1949 when prices actually recovered) did even more – circa 90 percent.

Downsizing employment is never fun, but often necessary for long term maintenance of financial and economic health. Most of us (including myself) have been there more than once. What does one do? You pick yourself up, you improve your attitude and you move forward. It is all part of life which cannot (and should not) be avoided.

The legacy media is also making too much “noise” with respect to tariffs. The Trump Administration is merely “threatening” tariffs equal to what respective countries have been charging the USA. These countries can simply lower or eliminate their tariffs and then there will be no tariffs on either side.

Global Geopolitics

The “trade wars” in the news today will not (and should not) last long especially with the most major global players such as the USA and Mainland China. Smaller players such as the European Union and Canada need to wake up, smell the coffee, face the music and reach mutually acceptable deals so that the tariffs need not last.

Every single hot war must be ended – no exceptions. The noisiest ones right now are those in the Ukraine and in the Gaza Strip. Put your politics and all religion aside because all civilian human beings need to be treated with respect.

As Vice President J.D. Vance said, the European Union needs to wake up, be reasonable and accept reality. They must forever give up their idea of “rearming” (with money they don’t have) and confronting Russia, Eurasia and beyond. And for what purpose might I ask? They are good people over there and need to be lived with (and traded with) in peace and prosperity. Forget about your so-called political, religious, ideological or cultural differences – do not use your beliefs as instruments of conflict. This interview with retired U.S. Colonel Douglas MacGregor of “Our Country, Our Choice” by Glenn Diesen of Norway is excellent. It sums up the current global geopolitical situation excellently: https://www.youtube.com/watch?v=IWGhXB1uszI.

What the European Union has done to nullify free elections in Romania and very recently in France (in effect to “legally” ban their parliamentary opposition) is nothing less than tyranny. Europe and the so-called liberal west have no chance whatsoever to overcome the BRICS and Shanghai Cooperation Organisation countries who represent from 79 to 91 of the human race on planet earth. If the USA joins forces with the latter the west will merely be “defeated” that much sooner rather than later. If the USA changes its politics once again in January 2029 it looks to go very hard left (i.e., the far left wing of the Democratic Party championed by the likes of Bernie Sanders and AOC). This will merely send the USA into bankrupt oblivion harder and sooner than softer and later. This phenomenon is unfortunately part of the human condition which I will refer to as “affluenza.” It happens to countries, states, provinces, corporations, smaller businesses and families. It is much like the spoiled rich children squandering their inheritance.

Financial, Economic and Social Mood Update (March 1, 2025)

The remaining, left-over, rump, vestige, liberal left-wing socialist woke DEI alliance consists of the following national or autonomous territorial governments in the “lackey” west: Canada, Germany, South Korea, Poland, Portugal, Spain, the Ukraine, Albania, Norway, Denmark, Slovenia, Estonia, Australia, Taiwan, Romania (the left wing annulled a Presidential election here in December 2024 because they did not like how the Romanian people voted), Belgium, Switzerland, Puerto Rico, Moldova, Montenegro, Malta, the UK, France and Iceland = 24 governments = legal jurisdiction over 6.51 percent of the global population. 44.24 percent of the reported votes in these 24 jurisdictions are center or right-of-center.

And many of these countries are very small. The bigger “keys” here which will make the façade collapse include Canada, Germany (the CDU/CSU need to wake up and cease forming coalitions with the destructive Social Democrats and the ultra-destructive Greens), the Ukraine (the money to the corrupt dictator Zelensky and his side must end 100 percent), Taiwan (the west needs to stop this issue entirely and allow Taiwan and mainland China to work together as they choose), the UK (Keir Starmer was installed by Barack Hussein Obama before the latter’s power structure collapsed to the ground, and if the election were held today Nigel Farage & his Reform Party may likely succeed) and of course France (Emmanuel Macron stands a good chance of losing to Marine LePen in an honest electoral contest). Here is a good video released by George Galloway of the UK. George is a socialist, and I would never vote for socialism – but he an honest man with some good common sense: https://www.youtube.com/watch?v=acl_VTtWTXA.

If the radical left retains political power in these areas, the respective countries and jurisdictions will merely continue to fall to the ground economically, financially, socially and geopolitically. This is what has transpired in Germany for the last 4 years (since 2021) and it is what happened to the USA from 2021 to 2025. It looks like the incoming government in Germany will not be much better. Due to insane “green” policies, retail energy prices in Germany have increased by a crippling 9-fold in just 3 years. These policies include shutting both nuclear & coal power plants and replacing them with wind and solar plants which fail to work when there is not enough wind and/or not enough sunshine – something that does take place especially during the winter months when people need heat the most.

Germany – the heart of Central Europe (“Mitteleuropa”)

Europe is in desperate need of a brand new and comprehensive security arrangement to replace NATO once and for all. This brand new arrangement must include countries such as the Russian Federation and Belarus as equal partners, and acknowledge Russia as the number one and largest power in Europe. Germany is the largest nation in Central Europe, and the German economy (the “locomotive” of Europe) must return to good health not merely for the sake of the Germans but for all of their smaller European neighbors who do well when Germany prospers and who suffer when Germany suffers.

All German political parties across the political spectrum must abandon forever any effort for German rearmament – and the same holds true for every single nation in Europe now part of the European Union or the EFTA. There must never be any more conscription for military service – all militaries in Europe should be small, only for self-defense (no deployment outside of their own national borders) and no nuclear weaponry. War must never again take place. Remember, respect and honor the fallen of two world wars from 1914 to 1945 and ensure that war never happens again. If the fallen soldiers of all sides were to return to us today, they would all tell us that no war is worth it. Furthermore, many of them would become best of friends of they were to meet each other as individual civilians. “No more war” means “no more war” – no ifs, ands or buts. No exceptions, period.

Russia and the many countries in the vast Eurasian continent – including Central Asia, the Indian subcontinent and the Middle East represent to no threat whatsoever to Europe and the world. Peaceful relations must exist between all and everyone should seek to foster economic and financial trade for the benefit of all. Europeans must cease thinking of countries such as Russia, China, Iran and beyond as adversaries. Think of them instead as good neighbors, trading partners and friends. Respect their many diverse cultures, trade with them as equal business partners and visit them as friendly and respectful tourists.

Real Estate – Housing Market in the USA

In last month’s blog we discussed the un-affordability of modern housing especially in the USA, but this situation also exists in many other countries of the “lackey” west such as Canada, Australia, Germany, the UK and the Philippines. In short, nominal asset prices are absurdly high in relation to how much people can and do earn in their jobs. Regions with the highest asset prices are only “affordable” for the few people who have very much money (largely either inherited family money or people with equity interests in high technology, big pharma or the defense/war industry). These places tend to attract people based upon a mild climate, retirement communities (normally age 55 and above with no minor children) and they tend have what I will refer to as “island economies” – overly dependent upon tourism and not enough core industry or “real” industry such as manufacturing and making things which have any value. In other words, they are expensive places with too few good jobs and too many lousy jobs.

The least affordable US states in order from top to bottom are 1) Hawaii, 2) California, 3) Montana, 4) Idaho, 5) Washington, 6) Utah, 7) Oregon, 8) Arizona, 9) Colorado, 10) Nevada, 11) Massachusetts, 12) Florida, 13) New York, 14) Maine, 15) Rhode Island, 16) New Jersey, 17) New Mexico, 18) the District of Columbia, 19) New Hampshire, 20) North Carolina, 21) Vermont and 22) Tennessee. These states and Washington, D.C. are the least affordable parts of the USA. Hawaii is overly dependent upon tourism and is a magnet not just for tourists but for idle people with too much money. California used to be (past tense) very economically powerful but has been in a marked decline for some time now due to bad politics, too much crime and losing its economic base. Many of the other expensive states have become so due to so many newcomers (especially from California) moving to them. The Californians are attempting to run away from their problems, but in truth all they do is to take their problems with them and thereby burden these other areas with the exact same problems. These “new” residents also price local people out of their own areas.

Montana, Idaho, Washington, Utah, Oregon, Arizona, Colorado and Nevada definitely fall into this category. States such as Massachusetts, New York, Maine, Rhode Island, New Jersey, DC, New Hampshire and Vermont are “older” American states with historically better core economics and higher wages. Florida is an historical magnet for both tourists & retirees but is now burdened with the highest insurance rates and very high property taxes as well. New Mexico is one of the poorest states in the union and also ranks dead last in public education – it is a lesser example of the group of states to which Montana belongs. North Carolina and Tennessee are among the states in the old South which have been the most dramatically changed for the much the same reason as Montana and New Mexico – they have been overrun by newcomers from the coastal northern states and from more affluent states from which residents have been fleeing.

Financial, Economic and Social Mood Update (February 1, 2025)

The automotive industry has been one of the leading industries worldwide for almost 140 years. It is now experiencing the biggest and most significant changes since then due to market over-saturation and excess production capacity (largely due to human demographic changes resulting in an ageing population and due to the over-use or abuse of credit financing) and due to the change into new technologies beyond the traditional internal combustion engine powered by crude oil products such as gasoline and diesel fuel.

Companies based in mainland China and those selling their retail automotive products in China now comprise 35 percent of the global market with Chinese companies manufacturing and selling 80 percent of all electric vehicles in the world. The entire global automotive market is forecast to contract (or shrink) by half in less than one decade or less than 10 years from today – perhaps as soon as just five (5) years from now. A channel on YouTube which reports on this daily is called “the Electric Viking.”

All of the so-called “legacy” automakers based in the USA, Japan, South Korea, Germany, France and Italy may not survive these changes. The largest automakers in the UK (formerly MG-Rover) and in Sweden (Volvo Cars) are already owned by Chinese companies – by SAIC (Shanghai Automotive Industrial Corporation) and by Geely, respectively.

This alarming phenomenon is not limited to the automotive industry and is also affecting major motorcycle manufacturers such as Kawasaki of Japan (down 23 percent in annual unit sales volume since their record year of 2019). Suzuki of Japan manufactures passenger cars & trucks plus motorcycles – they have also experienced a sales decline although not as severe (down 4 percent since 2018). Even one very large Chinese automaker has experienced a market sales decline – SAIC is down 18 percent since 2018. In addition to purchasing the former MG-Rover of the UK SAIC is known for major joint ventures with Volkswagen of Germany and with General Motors of the USA (the Wuling brand name). Two automakers bucking this downward trend are Geely of China (they own Volvo of Sweden, Proton of Malaysia, Smart of Germany and Lotus of the UK among their many brands) and Tata Motors of India. Tata owns Land Rover and Jaguar of the UK. The latter brand is doing very poorly, but their main Tata brand continues robust growth. Geely is also a major minority shareholder in Aston-Martin of the UK (17 percent of equity).

The remaining 13 global “legacy” automakers have already collapsed in annual unit sales volume from their respective record sales volumes:

- General Motors Corporation (USA): down by 73 percent

- Nissan Motor Corporation (Japan): down by 45 percent

- Groupe Renault (France): down by 44 percent

- Mitsubishi Motors Corporation (Japan): down by 34 percent

- Ford Motor Company (USA): down by 34 percent

- Honda Motor Company (Japan): down by 29 percent

- Stellantis NV (Italy-France-USA): down by 27 percent

- Mazda Motor Corporation (Japan): down by 23 percent

- Volkswagen Group (Germany): down by 22 percent

- Mercedes-Benz Group AG (Germany): down by 17 percent

- BMW AG (Germany): down by 17 percent

- Hyundai Motor Group (South Korea): down by 15 percent

- Toyota Group (Japan): down by 11 percent

The next topic I would like to discuss is that of real estate, banking and homeowner’s insurance – all very closely related and not only relevant to locations recently targeted with destructive fires such as Maui, Georgia, North Carolina or Malibu. The world (especially mainland China but even more so in the USA) finds itself in the most massive “everything asset bubble” in history – this must and will soon burst and crash to the ground. Commercial banks, investment banks and insurance companies (all of which use a very similar “business model”) now hold a tremendous amount of bad assets (non-performing or poorly performing loans on real estate, motor vehicles and more) which have yet to be acknowledged and written off as bad. Real property asset prices are so overly insane that a conventional insurance policy covers no more than 57 percent of current maximum “fair market value.” In other words, if you are struck with tragedy (the loss of your home) – even if you are insured – you are still screwed. You will have lost that which cannot be replaced (perhaps life, pets, and family treasures) and your policy will only cover a part of your rebuilding cost. New construction costs in the San Francisco, Bay Area of California now run from USD $589 to $1,276 per square foot. Mainstream news media outlets reported that rebuilding costs in and around the Malibu area average USD $1,000 per square foot. Prices in urban Virginia range from USD $209 to $704 per square foot. In metropolitan New York-New Jersey they go from USD $522 to $939 per square foot. Costs in urban Arizona range from USD $271 to $566 per square foot and in New Mexico from USD $425 to more than $1,000 per square foot. These prices are simply not sustainable – the overwhelming majority of people (even in the most affluent locations with the highest median or average incomes) cannot afford this.

Furthermore, real estate values are so sky high and insurance costs have gone so sky high (due to valid market circumstances) that fully 35 percent of homeowners today have NO HOMEOWNER’S INSURANCE. And then consider that 78 percent of Americans are now renters because they simply cannot afford to purchase or mortgage a home. In certain areas insurance is so bloody expensive that real estate prices are finally falling due to this fact – this is now the case in Florida, Louisiana and Texas. Many “real” insurance companies will no longer even sell policies in these areas and have stopped doing so in parts of southern California – which makes perfect sane sense. Local governments in some of these areas including Florida and California have “created” this horrific predicaments by controlling how much insurers can charge. This socialist insanity has resulted in insurers leaving these areas altogether and the insurer of last resort being – guess what – the government. And needless to say, the government product “sucks” compared to the real product.

Real estate prices need to come down a good 45 percent overnight just to try to approach any level of supposed sanity and when the entire “everything asset bubble” collapses in the very near future they must fall by a cumulative more than 95 percent.